Simplify your business and get paid faster.

Australia's favourite all-in-one payment solution with low fees, top tier security and same day support.

No setup fees

24/7 support

PCI compliant

-

5000+

Aussie Businesses

-

Industry

Leading Security

-

99%

Uptime Guarantee

-

100%

Australian Owned

Why PayChoice

Grow your business with Australia's favourite payment provider.

Everything you need to accept payments, manage transactions, and grow your business — all in one powerful platform.

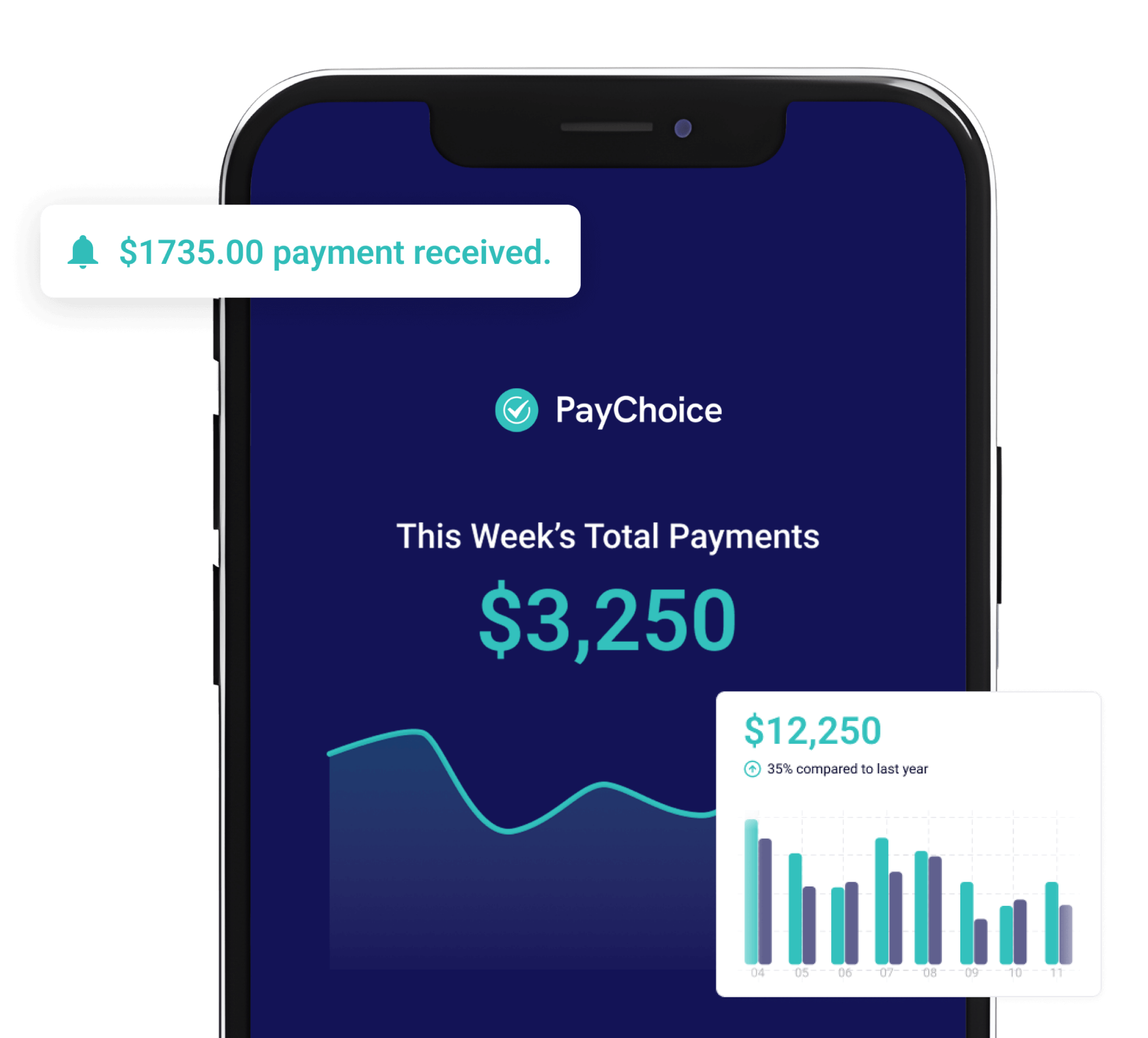

Increase Revenue

Boost sales and keep customers happy by accepting Visa, Mastercard, credit cards, and digital wallets.

Pay less fees

Cut unnecessary costs and keep more money with low transaction fees from leading payment processors.

Streamline operations

Streamline operations with automated payment processing and sync directly to your bank account.

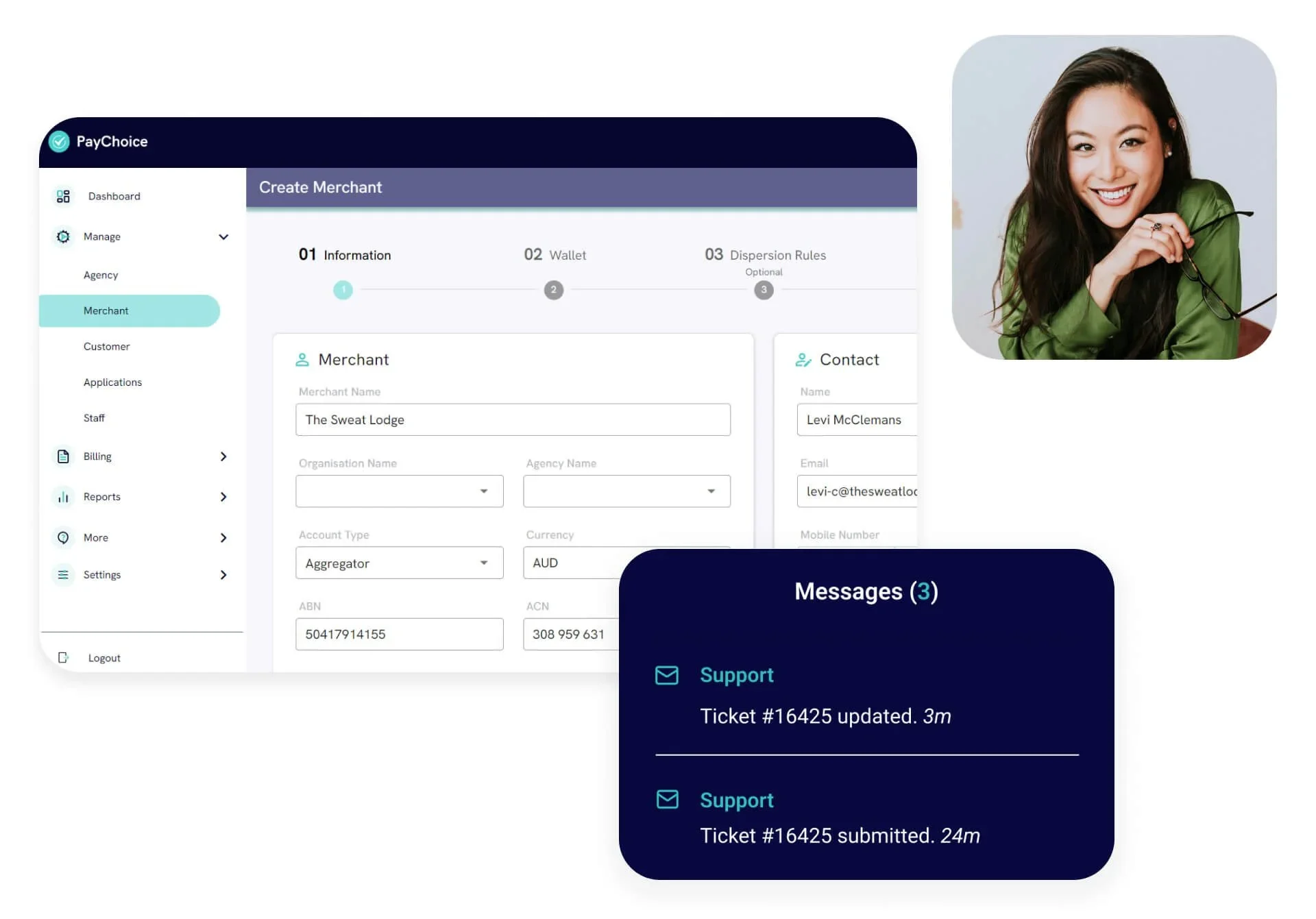

Get fast support

No more being ghosted by tech support. Get same-day service with our 24/7 Australian team.

Our Products

All your payment needs in one place

Whether you're a startup looking to get up and running, or an established business looking to streamline operations, we've got you covered.

-

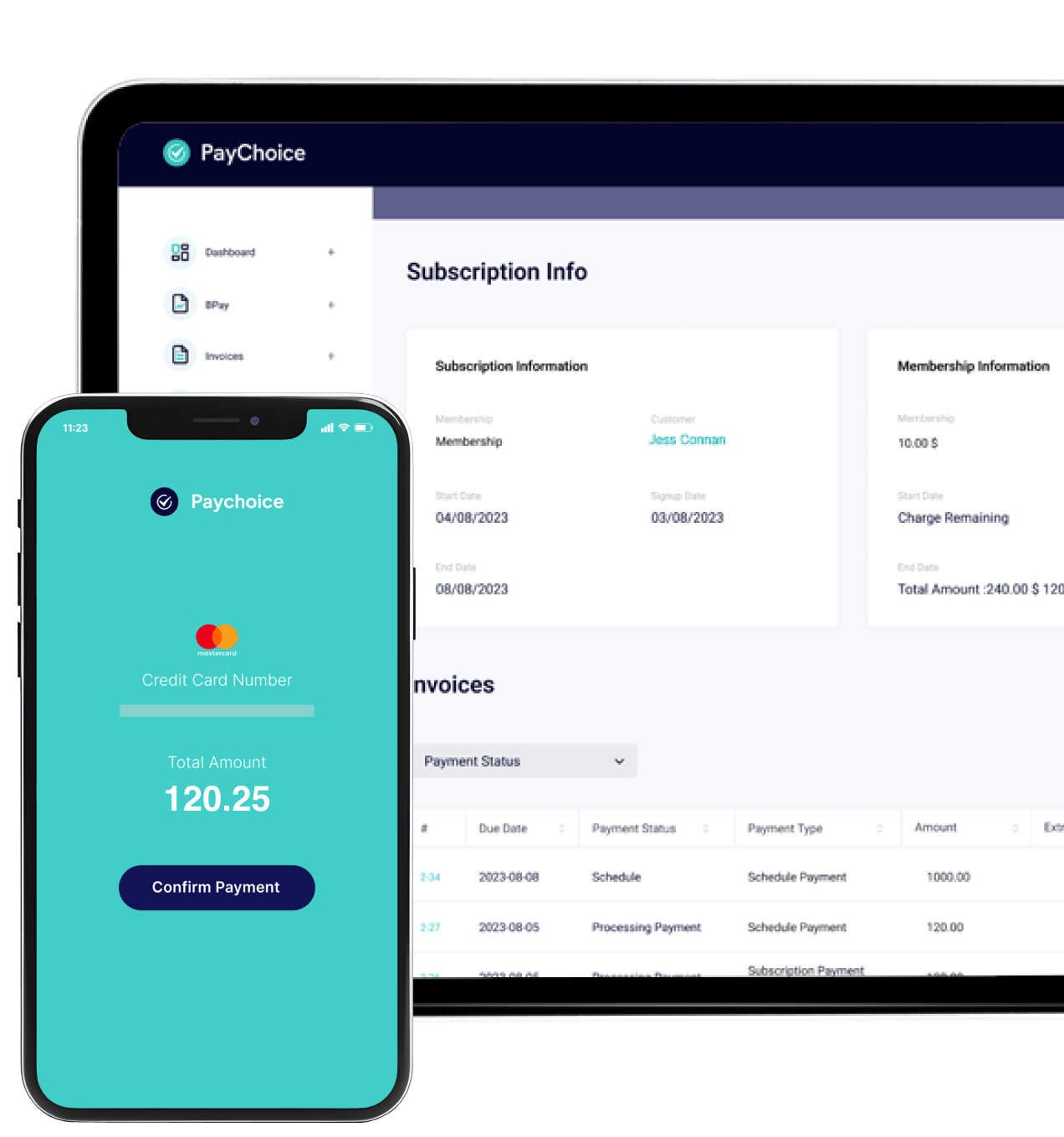

<span>Direct Debits</span>Say goodbye to chasing up payments with direct debits. A set and forget solution, perfect for memberships, subscriptions and recurring payments.

Automated recurring billing

Flexible payment schedules

Failed payment retry logic

Real-time notifications

-

<span>Online Payments</span>Powerful online payment gateway accepting all major credit cards, debit cards, and digital wallets with industry-leading security.

All major cards accepted

3D Secure authentication

Apple Pay & Google Pay

Instant settlements available

-

<span>EFTPOS</span>Modern EFTPOS terminals for your physical locations. Fast, reliable, and integrated with your existing systems.

Tap-and-go enabled

POS integration

Portable terminals

Same-day settlements

-

<span>API Web Services</span>Powerful APIs and webhooks for seamless integration with your existing software and workflows.

RESTful API

Sandbox environment

Comprehensive documentation

Dedicated support

Grow Your Business

How to use PayChoice to grow your business

Whether you're a startup or an established business, we have the tools to help you scale efficiently.

-

Make getting paid easy. Automate your recurring payments with direct debits so customers are billed on time, every time. No chasing invoices, no awkward follow-ups, and no missed payments. Perfect for memberships, subscriptions, programs, or ongoing services. Simply set it once and let PayChoice handle the rest.

-

Need to collect a one-off payment fast? Create and send secure payment links in seconds. Perfect for deposits, cancellations, overdue invoices, or quick purchases without needing a website or terminal.

-

If you're not already taking online payments, we make it a breeze. With PayChoice you can sell products, services, sessions, memberships, digital items and more with fast and secure online checkout options. Whether you already have a website or are starting from scratch, we give you everything you need to accept payments instantly.

-

Whether you need your first Eftpos terminal or you're ready to switch providers, PayChoice makes it easy. Fast setup, reliable machines, lower fees and quick payouts. A simple, seamless way to take in-person payments without any of the usual headaches.

-

Most businesses are paying more than they should on transaction fees. When you switch to PayChoice, you save on processing costs so more money stays in your business. No hidden fees, no complicated pricing, just a more cost-effective way to take payments every day.

-

Slow payments hurt your cashflow. PayChoice helps you get paid faster through automated billing, online payments, instant checkout links and fast settlement. Less waiting, less admin, and more predictable revenue coming in each week.

-

Keep everything connected and running smoothly. With our API web services, you can integrate directly with your existing software so payments, customer details and billing information stay perfectly in sync. No more exporting spreadsheets, retyping customer info, or fixing data errors.

Industries

Industries we work with

From fitness studios to schools, we power payments for thousands of Australian businesses across all sectors.

Health & Fitness Perfect for gyms, studios, and personal trainers

Childcare Streamline parent payments and billing

Associations Manage member dues and subscriptions

Schools & Education Handle fees, donations, and fundraising

Nonprofits Accept donations and recurring contributions

Professional Services Invoice clients and collect payments seamlessly

Integrations

Easily connect to your software.

PayChoice integrates with your existing payment systems and payment processors, so you can kiss goodbye to double handling and manually following up customers.

Seamless Integration

Connect to 100+ popular business tools and platforms

Auto-Sync Data

Automatically sync payments, invoices, and customer data

Get up and running in minutes with guided setup

How It Works

Get started in 4 easy steps

We make it simple to switch to PayChoice. Our team handles the heavy lifting so you can focus on your business.

Contact Us

Send us a message to get in touch with our team.

Free Quote

We'll catch up for a call, discuss your needs and give you a clear, upfront quote based on your business.

Free Onboarding

We handle the setup for you, integrating with your software and making sure everything works smoothly.

Ongoing Support

Start taking payments right away, with ongoing support from our team whenever you need it.

FAQ

PayChoice FAQ

Got questions? We've got answers. Here are the most common questions about our payment gateway services.

-

An Australian payment gateway acts as the secure digital bridge between a business and the banking network. It validates customer card details, authorises funds, and securely routes money from the customer's bank to the merchant's account—whether the sale happens online, in-store, or over the phone.

-

The process happens in seconds using a secure four-step flow:

Tokenisation: First, PayChoice instantly replaces sensitive card data with a secure, unique token so the actual details are never stored or exposed.

Encryption: This token and the transaction data are encrypted to bank-grade standards for safe transmission.

Charge: PayChoice processes the charge by communicating with the customer's bank to confirm funds and authorise the payment.

Settlement: Once approved, the transaction is finalised, and PayChoice routes the funds directly to the business account.

-

PayChoice consolidates all major payment types into one platform:

Cards: Visa, Mastercard, and major credit/debit cards.

Direct Debit: Automated processing for recurring bank transfers.

Local Options: BPAY and Australian-specific payment methods.

In-Person: Integration with EFTPOS terminals for physical retail.

-

PayChoice combines enterprise-level tech with local service:

Keep More Revenue: PayChoice offers some of the most competitive transaction fees in Australia.

Local Support: The PayChoice support team is based entirely in Australia—providing same-day assistance without offshore call centres.

Flexibility: Businesses can accept payments online, in-app, or in-person seamlessly.

Free Integration: PayChoice integrates with most eCommerce platforms. If a plugin does not exist for specific software, PayChoice will build a custom integration at no extra cost.

-

PayChoice prioritises business cash flow. While traditional banks can take days, PayChoice offers same-day settlement for eligible real-time payments. For standard card and Direct Debit transactions, PayChoice settles faster than most major competitors to ensure funds are available when needed.

-

Yes. Security is the core product. PayChoice is a PCI DSS Tier 1 compliant provider—the highest level of security certification available in the payments industry. PayChoice handles all compliance requirements, ensuring customer data is safe without adding administrative burden to the business.

-

Absolutely. PayChoice is a leader in recurring revenue. The automated Direct Debit system is designed for gyms, SaaS companies, and subscription boxes. It handles retries for failed payments automatically, reducing churn and guaranteeing steady cash flow without manual invoicing.

-

PayChoice operates with transparency and flexibility. There are no lock-in contracts and no hidden setup fees for standard accounts. PayChoice believes businesses should stay because they value the service, not because they are trapped in a long-term agreement.

-

Yes. PayChoice understands the importance of seamless reconciliation for Australian businesses. The platform provides detailed transaction reporting that can be easily exported for use with major accounting software, including Xero and MYOB, streamlining end-of-month reporting.

Ready to get started?

Join thousands of Australian businesses already using PayChoice. Get set up in minutes and start accepting payments today.

Free setup

No lock-in contracts

Cancel anytime